The cancellation of Ant Financials’ scheduled IPO last November signaled the start of a sustained push by Chinese regulators to clip the wings of major technology plays. That push expanded to other businesses seen as out of line with official goals and policies.

In their latest move, those regulators are proposing new rules requiring any Chinese company seeking to list on a foreign stock exchanges to carry out a cybersecurity review,

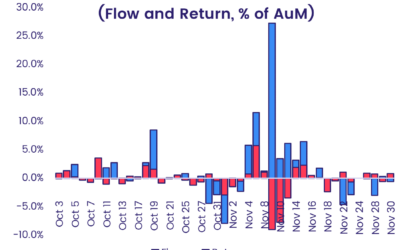

Not surprisingly, given these official actions, foreign investors are running shy of Chinese equity. Flows for China Equity Funds were negative eight of the past 11 weeks going into mid-August and fund allocations to foreign listed China share classes – ADR, N Share and S chip – continues to fall.

For investors and fund managers, one obvious question is, who is benefiting from this shift? Another is, how can I tell?

In both cases, EPFR’s core allocations data sets and the specialized China Share Class Allocations data set can help.

Casting a wider net in the search for clues

Elevated regulatory and political risk have shadowed Chinese foreign listings for some time now.

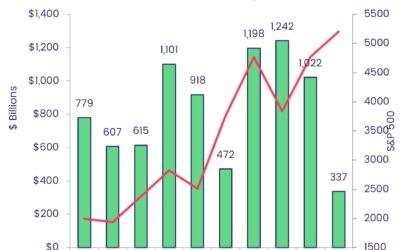

During the presidency of Donald Trump, foreign listed Chinese companies — especially tech companies — were threatened with de-listing of domestic security grounds. Fund managers reacted by decreasing their allocation to foreign listed Chinese share classes, starting in mid-2020. The trend accelerated in early 2021 when China Telecom, China Mobil and China Unicom were removed from the Dow Jones Industrial Average, a move that was followed by other benchmark providers (See Chart 1 below).

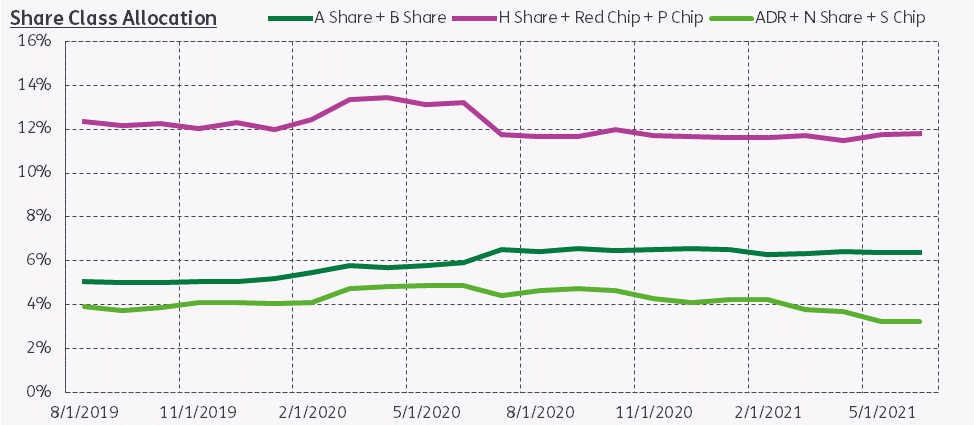

Chart 1 – China Share Class Allocation

Even though multiple academics have argued that China should be its own asset class, for the moment China is still a part of Global Emerging Markets (GEM) suite of investible countries. As a result, the interplay of various Chinese share classes is not the only lens available to investors seeking clues. The rotation of country-level exposure between China and other parts of emerging Asia is also a key tool.

Active measures

What is recent data, and some simple quantitative signals that can be extracted from it, telling us about investor responses to the changing climate, both at home and abroad, for Chinese listings?

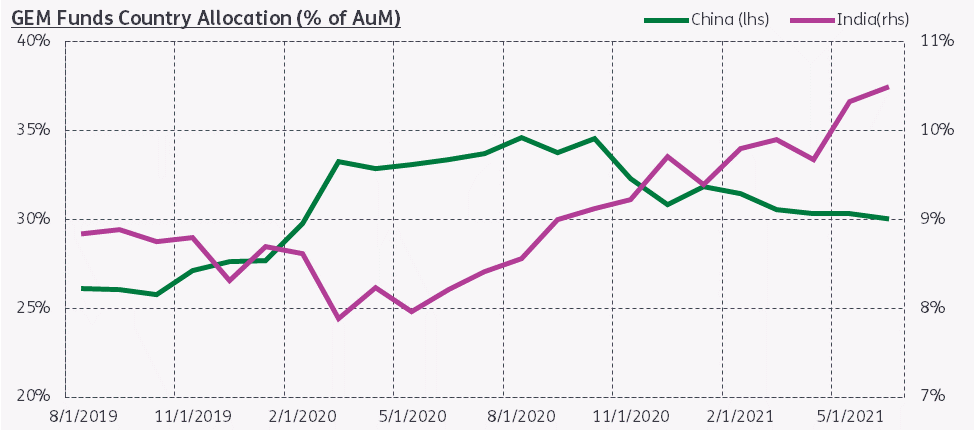

During the month of August 2020, the average EPFR-tracked GEM Equity Fund allocation to China reaches a fresh record high of 36.21%. Starting in November, however, that allocation has declined steadily, hitting a 15-month low of 31.28% coming into 3Q21. For India, meanwhile, the allocation among GEM Funds has climbed off a two-year low in late 1Q20 to a 51-month high of 10.87% (See Chart 2 below). Allocations to Korea and Taiwan have also climbed significantly over the past eight to 10 months.

Chart 2 – GEM Funds Country Allocation (% of AuM) to China vs India

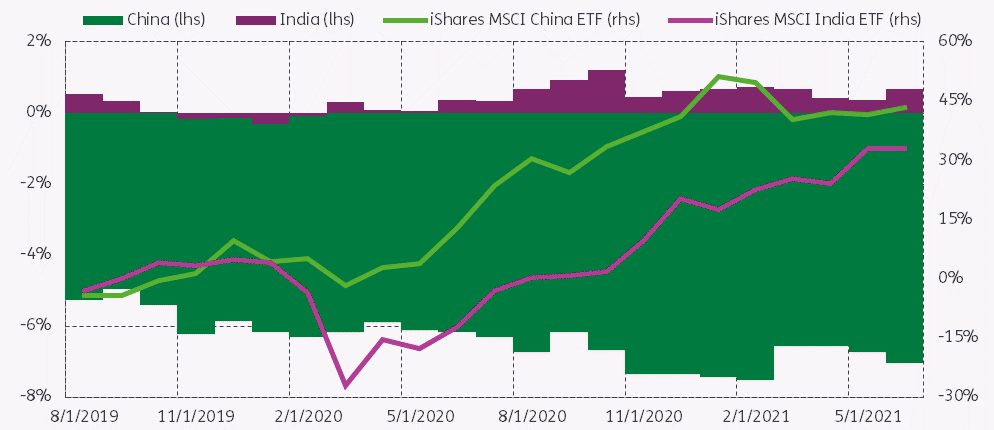

Narrowing the focus to China and India, we can use AIS – or active investor spread – to gauge this shift in favor of India. AIS is a measurement of the degree to which active fund managers are overweight or underweight a certain asset class.

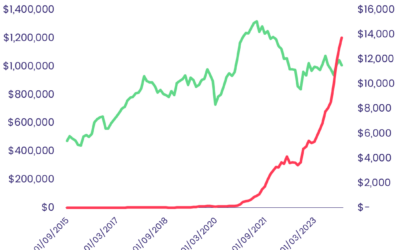

In Chart 3, the purple bar represents AIS for India and green bar represents China. We see a slight underweight for India during Q4 2019 and Q1 2020 which turns into consistent overweight from 2Q20 onward. For China, the a consistent underweight deepens

Chart 3 – AIS (Active Investor Spread) vs Benchmark Performance

Assigning the proper weight to the evidence

The underweight illustrated in Chart 3 could reasonably be the result of decreasing weight of ADRs, N shares and S chips.

Given that the domestic A shares benchmark has a pretty good correlation to the average fund’s exposure to A shares, a negative correlation between that benchmark and overall GEM Fund allocations to China points the finger at other China share classes.

If we lay AIS over ETF cumulative performances, we get a correlation of -83.24% and 45.64% for China and India respectively (here, we compare AIS at T-1 vs ETF cumulative performance at T). Therefore, we can conclude that for EM managers the interplay between all China share class is still the major cause of exposure changes.

Given the consistency of the AIS signal since the middle of 2020, we expect (a) that GEM fund managers will continue to increase their exposure to A and Hong Kong listed shares and (b) will rotate some of their foreign listed share class allocations to other major southeast Asia markets.

Did you find this useful? Get our EPFR Insights delivered to your inbox.