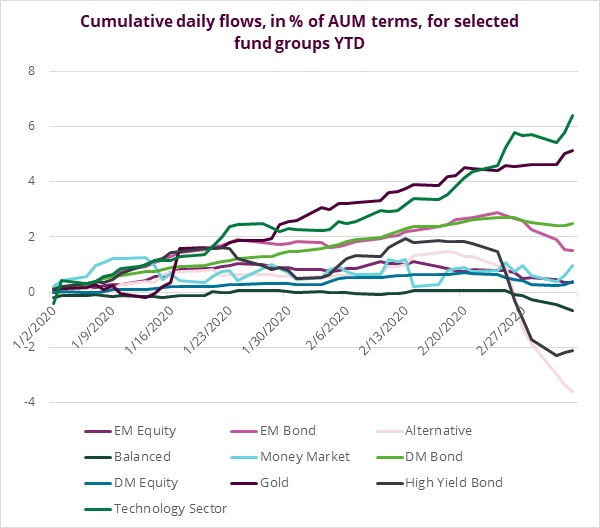

EPFR-tracked Bond Funds were swept up in the broad correction that hit most fund groups in late February, posting their first weekly outflow in over a year during the seven days ending March 4, as fears about the Wuhan coronavirus (Covid-19) continued to pummel asset classes ranging from oil to junk bonds. Flows into Money Market Funds climbed to a 30-week high while redemptions from Bank Loan and Total Return Bond Funds hit levels last seen in 4Q18, over $7 billion flowed out of High Yield Bond Funds and Balanced Bond Funds set a new outflow record.

Daily data did show flows for several major groups rebounding after the US Federal Reserve’s 50 basis points interest rate cut and Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates showed their customary resilience. Several fund groups – which did not include US Equity Funds – also benefited from safe-haven flows, and the reform story offered by Latin America’s largest economy kept fresh money flowing into Brazil Equity Funds.

Did you find this useful? Get our EPFR Insights delivered to your inbox.