With major central banks responding to rising inflation, investor focus shifted during the third week of December to the Covid-19 pandemic’s latest iteration and the measures being taken to contain it. Those measures, self-imposed and mandated, promise to dent consumer and business confidence going into the New Year and weighed on flows to many EPFR-tracked fund groups.

Among the hardest hit were Alternative Funds, which posted their biggest outflow since late 1Q20 as they extended their longest redemption streak in over two years. Cryptocurrency Funds posted their first outflow since mid-August, redemptions from Global Equity Funds hit a 91-week high and nine of the 11 major Sector Fund groups saw money flow out.

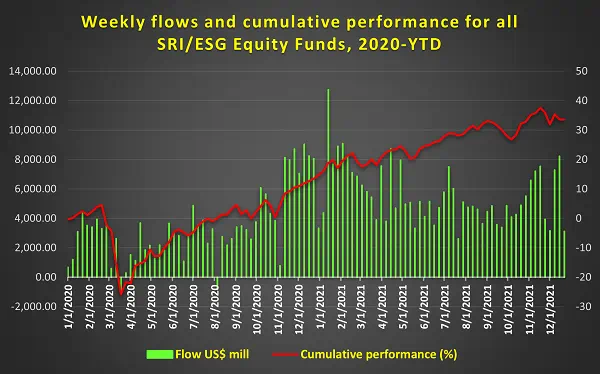

Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates continue to fly above the general storm clouds. During the week ending Dec. 22, SRI/ESG Equity Funds chalked up their 153rd inflow in the 155 weeks since the beginning of 2019 and SRI/ESG Bond Funds their 150th.

Did you find this useful? Get our EPFR Insights delivered to your inbox.