For decades, global investors have become conditioned to the term Asia ex(cluding) Japan. It’s a term that reflects Japan’s individual place in the current investment universe.

In this week’s Quants Corner, we illustrate how Japan’s stock market is different – from a fund flow perspective – compared to the rest of Asia, and how we can generate alpha at a stock level in such a unique market.

China throwing shade

In the 1980s, Japan equity market looked set to overtake the US, and became the world’s largest stock market by market capitalization. However, that did not happen. Instead, Japan’s stock market became the largest in Asia, and the mutual fund industry took note.

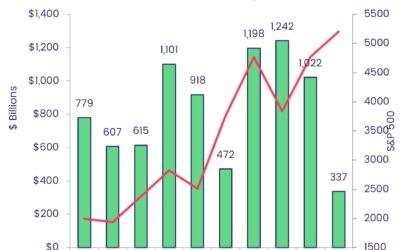

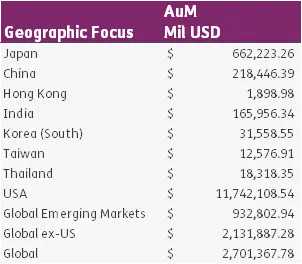

As of August 2020, total net assets of Japan dedicated funds (ETFs and Mutual Funds) stands at US$662.2 billion. This total exceeds the combined assets currently under management in China, Hong Kong, India, South Korea, Taiwan and Thailand country dedicated funds (See Chart 1).

Chart 1 – AuM by fund geographic focus

In recent years, interest in Japan has been crowded out by its fast-growing neighbor located just a few hundred miles away. China has drawn most of the financial world’s attention, as well as a good chunk of its investible cash.

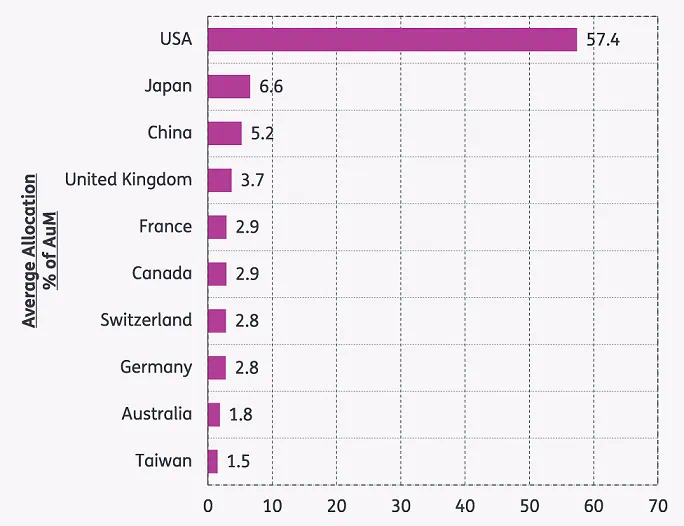

As of August 2020, Japanese equities only account for 6.6% of the MSCI’s benchmark ACWI index. That’s only 1.4% higher than the index’s allocation to China (See Chart 2).

Chart 2 – ACWI ETF Allocation as of August

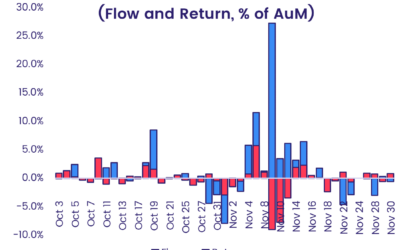

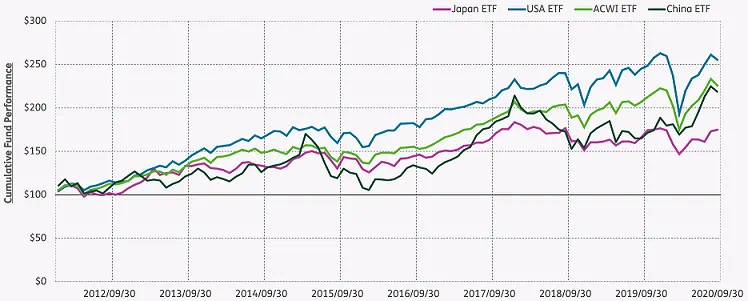

And if we look at the history (See Chart 3), the gap between Japan and China is closing faster than ever before.

Chart 3 – Cumulative ETF performance

The cat that walks alone

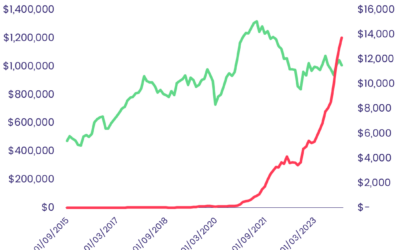

The outcome of these current trends is clear and simple: Japanese equity is under-performing compared to the US, ACWI, and Chinese benchmarks (see Chart 4).

Chart 4 – Cumulative ETF performance

Perhaps of greater interest is the relationship between Japan’s equity markets and its regional and global peers.

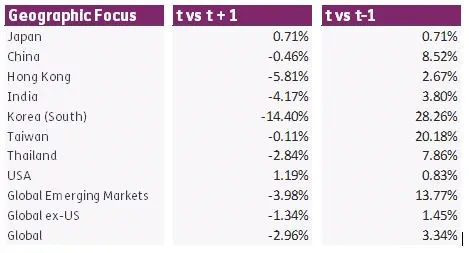

Chart 5 below illustrates the correlation between Japan and other benchmarks on t vs t+1 basis. It suggests that:

- Japan’s current performance (on a monthly basis) has a very weak reversal correlation with the future performance of other Asian stock markets and global indices future month performance.

- The past performance of these indices has a slightly higher momentum correlation with Japan stock market.

Chart 5 – Japan vs other benchmarks, correlation of

Unlike the liquid US market, where domestic investors are so good that foreign players struggle to claim a fraction of the available excess returns, Japan’s equity market appears to be responding to the gravitational pull of other markets.

Factoring in a unique situation

Given the uniqueness of Japanese market dynamics, finding alpha in the universe covered by the TOPIX index is challenging. But, by deploying the right factors, that challenge can be met.

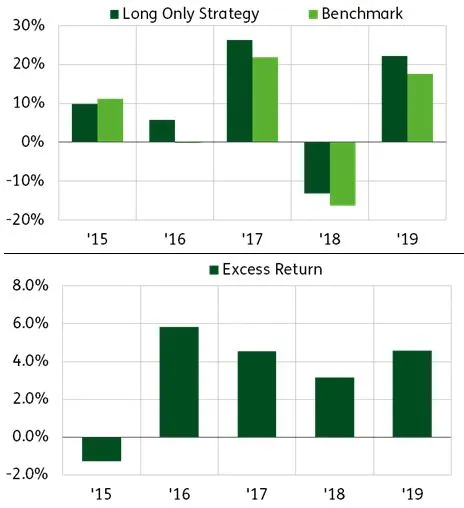

Below long only strategy is built upon EPFR’s proprietary stock level factors – Herfindahl, AllocMo, AllocTrend and AllocSkew (see definition in Appendix 1) – that is applied to a base portfolio of stocks that are held by actively managed Japan Equity Funds and are listed in the TOPIX. Here, Herfindahl is a short-term (two-month) momentum signal, and accounts for 80% of the factor weight. The remaining factors are long term (12-month) reversal signals, and account for 5% of the factor weight each.

The extend of the overweight or underweight for this strategy is calculated by applying these factors to adjust the base portfolio, which is organized into a cross-sectional normal distribution format. The top 50% of the securities lying to the right of the mean distribution are overweighted, the 50% furthest to the left are underweighted. Rebalancing takes place on a monthly basis.

Our historical back-testing – Chart 6 – shows a steady increase in excess performance, and the strategy has outperformed the benchmark four of the past five years. (Chart 7).

Chart 6 – Strategy historical performance

Chart 7 – Strategy annual performance

With foreign investors consistently moving money out of Japan’s equity markets and China claiming a growing share of widely followed indexes, it will be hard for the TOPIX to outperform its peers in the years ahead. But, by tapping the stock level holdings data of ETFs and mutual funds, it is still possible to generate alpha in Japanese markets.

Appendix 1 – Factor datapoints & formulas

Did you find this useful? Get our EPFR Insights delivered to your inbox.