Steven Xinlei Shen

Steven Xinlei Shen, Director of Visualization & Analytics at EPFR, uses quantitative analysis to extract value from fund flow and allocations data to help asset managers identify new strategies and detect market opportunities.

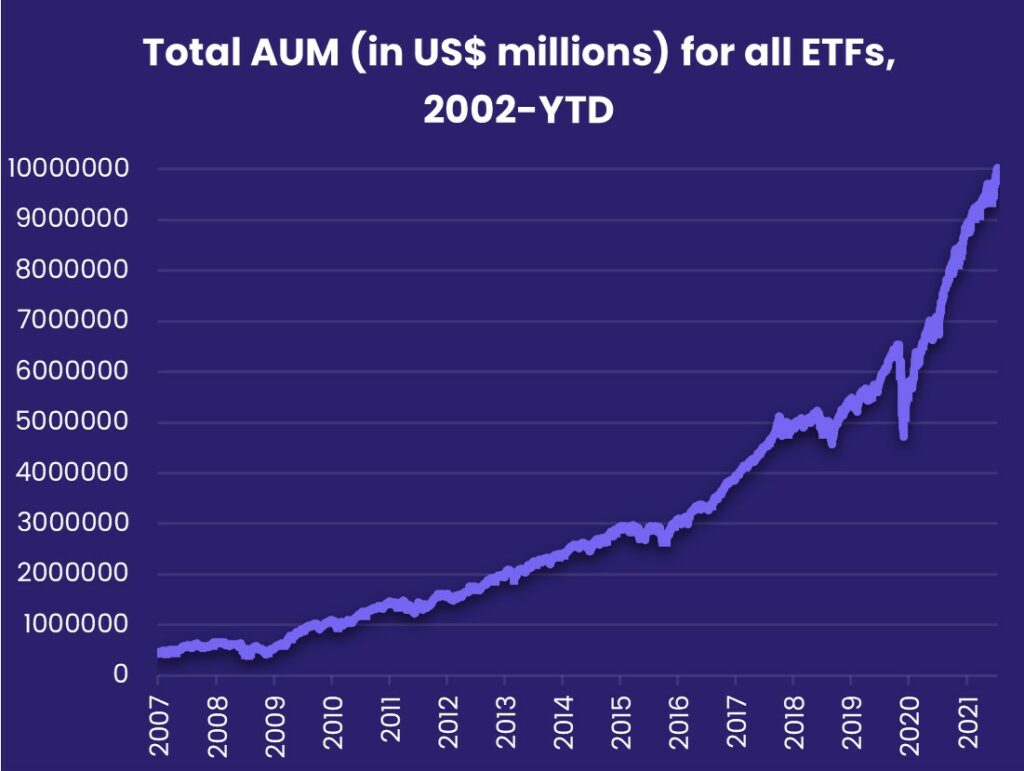

Steven works primarily with clients in Asia-Pacific (APAC) markets and U.S. clients investing in APAC markets, helping them mine the firm’s EPFR database of mutual fund and exchange-traded fund flows and positioning data across global markets. He illustrates the predictive power of the data through modelling, based on the distinct mandates of clients.

He specializes in fund flow quantitative strategy development, new data product development, new idea generation and visualization, and research consultation. Previously, he maintained all global asset allocation strategies as well as developed Asia dedicated country and sector strategies from the firm’s Shanghai office.

Steven, a native of China, is a recreational race car driver outside the office whose record speed is 200 mph at the track.

B.S., International Business and Economics - Shanghai University of International Business and Economics.

Master of Finance - Northeastern University.

Certificate in Quantitative Finance (CQF) - Fitch Learning.

“Most people think quantitative analysis is extremely complex. And it is. But sometimes, it’s beautiful in its simplicity. Sometimes, a simple dataset exposes an extraordinary condition lurking just below the surface. And a whole new market strategy emerges.”

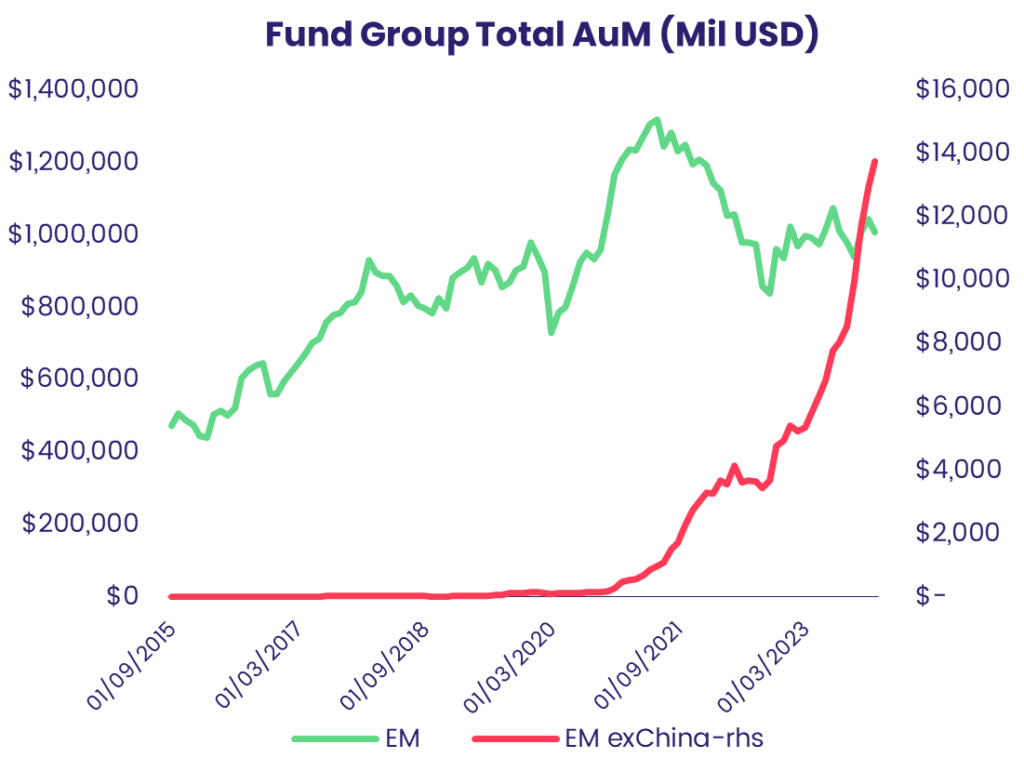

Ex-China Funds: A shooting star or a new constellation?

An unusual visitor comes knocking on Japan’s door. Did it RSVP?

Off the wires: ESG investors play the long game

Off the wires: Muni junk bond king John Miller to retire

Off the wires: Google launches Bard chatbot to rival OpenAI’s ChatGPT

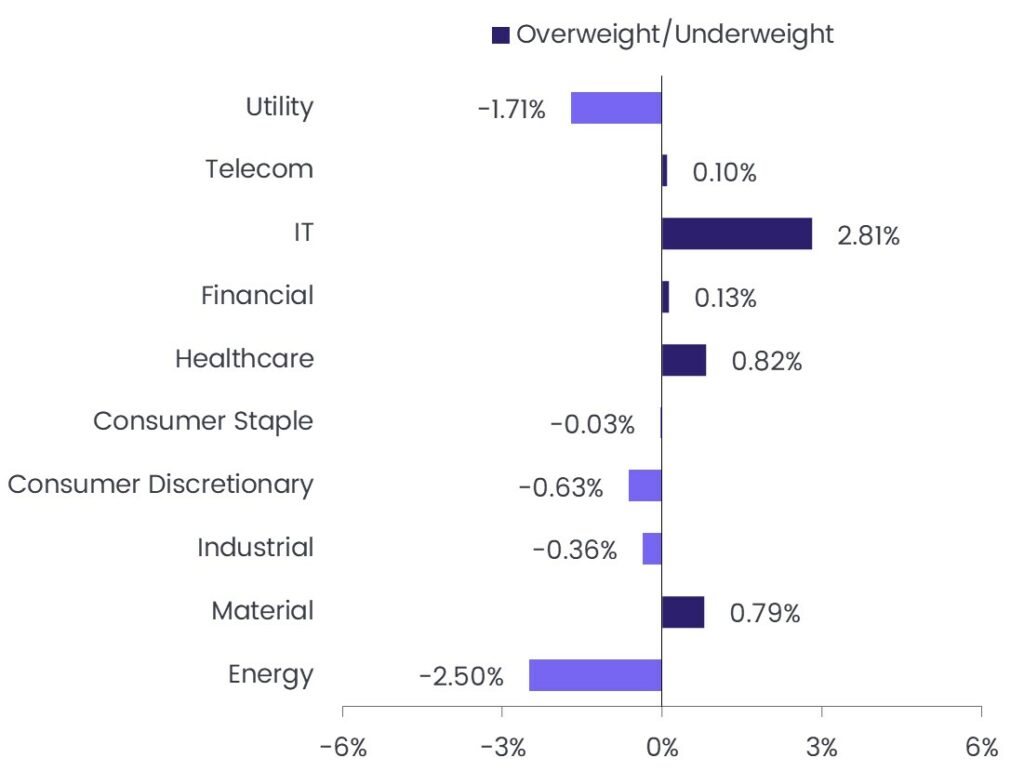

Market insights: An in-depth analysis of emerging markets in Asia

Off the wires: Tesla stock gathers steam as reports show EV giant hits brakes on China plant production

Off the wires: India raises $1bn from maiden green bond sale

Inflation is on the rise. So is fear

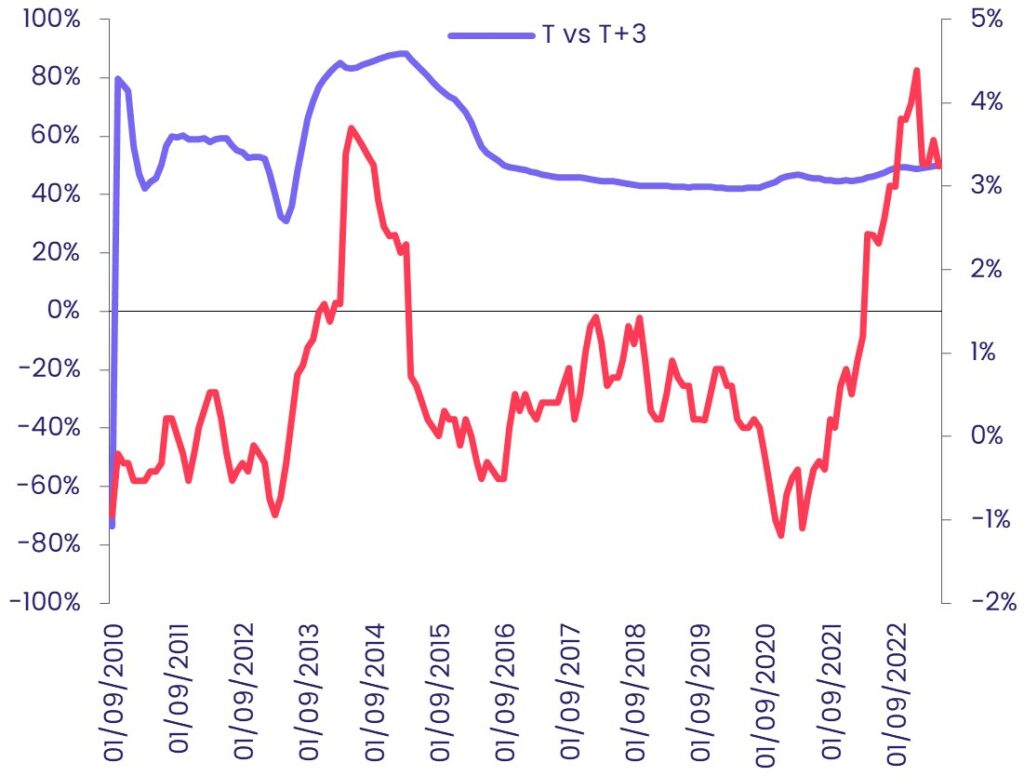

Quants Corner – Evergrande: Telling when it isn’t