Cameron Brandt

Cameron Brandt, Director of Research at EPFR, monitors the firm’s vast database of mutual fund and exchange-traded fund flows and positioning data across global markets.

As director, Cameron mines EPFR data to isolate themes and identify relevant trends –whether a spike in leveraged bear bonds or shifts in emerging markets– to help buy– and sell-side institutions make more informed decisions. He heads a team of 10 quantitative and qualitative researchers for the database, which tracks around 150,000 share classes and represents roughly $50 trillion of assets under management.

Cameron co-authored an International Financing Review (IFR)-published study of fund flows and produces regular reports on trends that emerge from the data, directing the focus of the research based on clients’ interest.

He previously worked as a journalist at a number of regional papers in the U.S., as well as the managing editor of now-closed World Paper in Boston, publishing a theme-driven international affairs supplement in emerging economies.

Cameron, who grew up in Scotland and Ireland, spends most of his time outside work with his two teenaged children. He also spends much of his time fishing for tuna, trout, carp and salmon, partaking in a pastime he sees as one of the last bastions of true social diversity.

B.A., Economics and Political Science; Yale University

“I spent years as a journalist canvassing communities and interviewing people to find the most compelling stories for our readers. At EPFR, my job is no different –I scour data tracking trillions of dollars looking for stories our clients can’t see. I build powerful narratives they can use to grow as a firm.”

The cruelest month shows its colors

1Q24 Recap Webinar

Investors feel the squeeze in early April

Market Insights: GEM Ex-China

Equity Research Webinar

America’s economic strength weighs on pivot projections

Market Insights: ESG update

Rate optimism shapes run-up to Easter

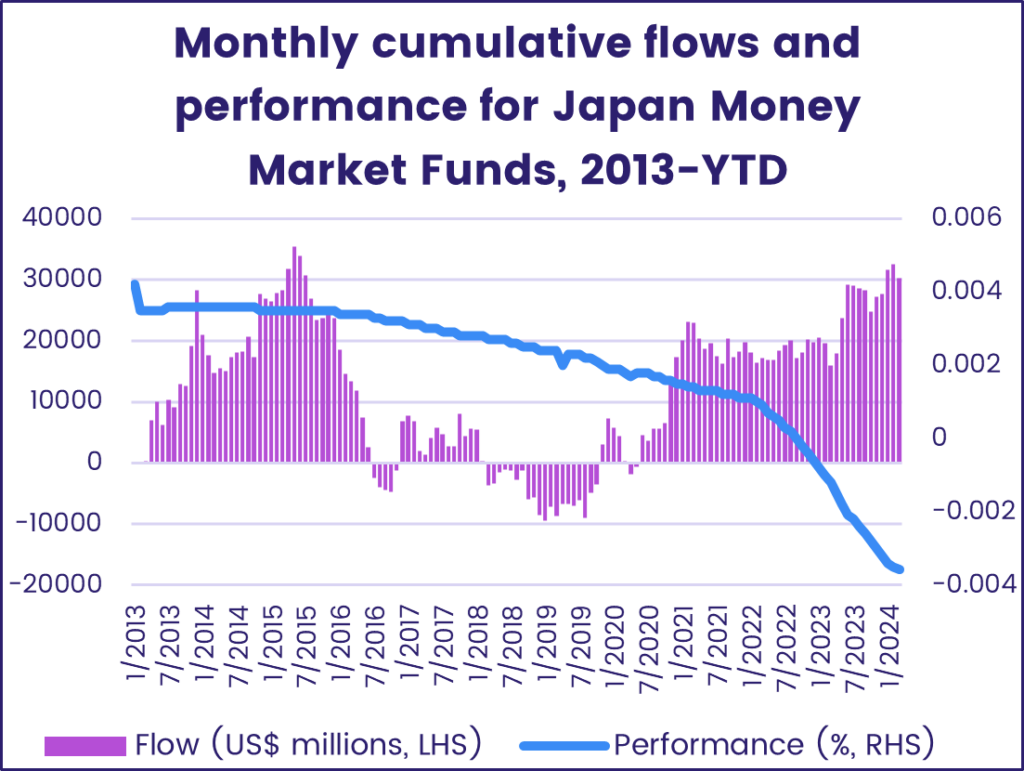

BOJ closes the book on negative rates

Rising tide doesn’t lift SRI/ESG Funds